Grow Your B2C Business Online Grant

$2,400 Grant For Your Canadian B2C Business:

To help you grow by selling online, with developing and marketing your e-commerce solution.

Contact us first – we will help you get approved and paid!

3 Steps:

- Decide on best options for your e-commerce solution and receive a formal quote.

- Get approved for $2,400 grant based on formal quote.

- Implement e-commerce solution as quoted.

The links to apply are below.

The following info and print screens are specific to applying for Ontario businesses and is very similar for other provinces.

click here for a PDF of this article

Before you apply, make sure you have all the following info ready to go:

The maximum funding available is $2,400 – the following is a guide aimed at making your application process as quick and painless as possible – but is no guarantee you will be approved or will receive full reimbursements.

You first need to apply and get approved, then pay for services, and then get reimbursed. You have up to 6 months from getting accepted to be eligible to be reimbursed. Recommend getting it all done in first month, as the quicker you spend your money the quicker you get reimbursed … and the quicker you can see the benefits of your investments.

To be eligible for the Grow Your Business Online grant, businesses must have either a minimum of one employee (other than the business owner) -OR- had at least $30,000 in annual revenue in the most recent tax year.

Applicants wishing to prove they have at least one employee must submit a paystub from an embedded payroll system – dated within the last 4 weeks.

Applicants wishing to provide proof of annual revenue must provide a signed Revenue Attestation Letter.

In the application you will be asked to upload the following documents. File types allowed are: DOC, DOCX, PDF, XLS, XLSX, PNG, JPG, JPEG. The max file size cannot exceed 10 MB.

(1) Revenue Attestation Letter

Revenue Attestation Letter Applicants wishing to provide proof of annual revenue must provide a signed Revenue Attestation Letter.

(2) Business registration

Proof of business registration (i.e. incorporation or registration documents, business/operating license etc.)

(3) (GST/ HST) Registration or Confirmation:

Recent documentation provided by CRA within the last 12 months (i.e. confirmation of sales tax (GST/HST) registration OR confirmation of recent sales tax (GST/HST) filing

Please briefly outline how you plan to use the Grow Your Business Online grant to grow your business and explain how your intended purchase(s) are related to this plan.

Along with formal quote, we will provide you with an outline like these examples:

NEW: We are investing in developing a new e-commerce website so our customers and prospective customers can use it to order our products and services and can pay online and subscribe to our ongoing solutions. Our plan is to install e-commerce into our website and add our products and services so at checkout customers can pay online. We will be spending our money on professional services to make the most of this investment.

UPGRADE: We are investing in upgrading our existing e-commerce site for added functionality. We will be improving our website (WordPress) and e-commerce (WooCommerce) so our customers and prospective customers can use it to order our products and services and can pay online and subscribe to our ongoing solutions. Our current setup has a catalogue and customers need to contact us for help ordering – we will be spending our money on professional services to make the most of this investment.

MARKETING: We will be immediately investing in professional services to launch digital marketing initiatives related to our e-commerce store. Our marketing strategy and action plan includes setting up and sending our first mass email / newsletter campaign with clear calls to action & incentives with links to new landing pages aimed at improving converting more visitors into buying online. We will also be investing in professional services to improve our SEO with adding content to help us rank higher organically in search results and further setting up and improving our Social Media accounts and adding posts aimed at promoting our e-commerce and increasing traffic to our website.

Choose the options most relevant to the e-commerce goals you aim to achieve using the Grow Your Business Online grant. Select all that apply.

- Developing a new e-commerce website

- Upgrading an existing e-commerce site for added functionality

- Search Engine Optimization (SEO) for an existing website

- Current or future advertising on social media (any platform)

- Launching digital marketing initiatives related to your e-commerce

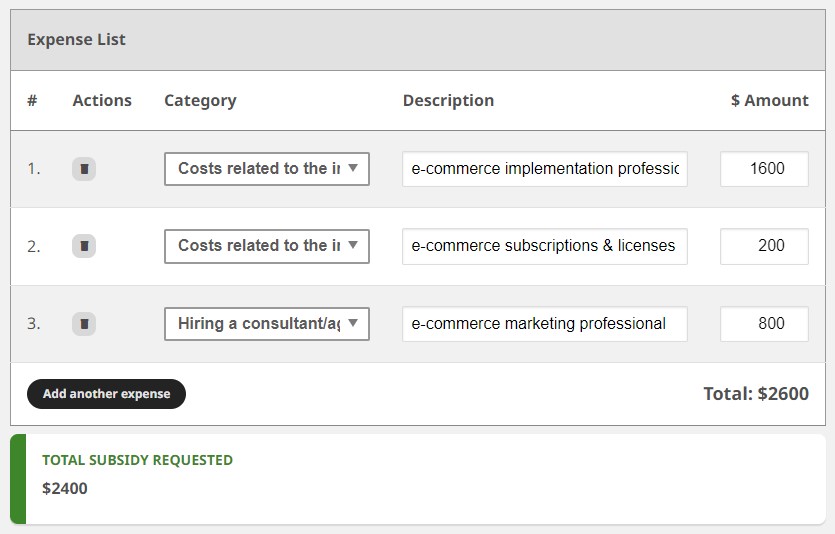

Please detail your planned eligible expenses in the budget summary below.

For examples, please see the list of eligible and ineligible costs.

Please enter the full amount of expenses, exclusive of taxes, you expect will be required to meet the goals of your Grow Your Business Online plan.

Note: Only a maximum of $2400 in eligible expenses will be reimbursed. You may not receive a subsidy for the full amount spent, based on the eligibility of individual expenses. Hardware and related software expenses are limited to 20% of the expense, to a maximum of $480, and must directly support your e-commerce adoption plan.

Contact us first for help with your options and in applying for this grant.

Ontario Businesses apply here: https://occ.ca/growyourbusinessonline/

For more info (and other provinces) see: https://ised-isde.canada.ca

To apply, select your province: